Forex Trading: A Step by Step Guidelines To Beginners

The Forex Trading market can be incredibly rewarding, but it comes with its fair share of risks. Jumping into the market unprepared can lead to costly mistakes. It is crucial to equip yourself with the necessary knowledge before diving in. The more prepared you are as a trader, the better your chances of achieving success.

Essential Steps Before Entering Your First Forex Trade: Understand the Forex Market

Begin by familiarizing yourself with key aspects of the Forex market, such as:

- Market structure

- Market participants

- Important terminology

- Factors influencing market movements

- And more…

Developing a solid foundation in Forex trading basics will enable you to assess risks and rewards effectively, hone your trading skills, and utilize essential tools and resources. To kickstart your understanding, delve into our comprehensive article on ‘What is Forex’.

Step 1: Select Your Forex Trading Method

Forex trading involves the buying and selling of currencies. Retail traders commonly use spot Forex CFDs and FX options. At AvaTrade, you have the flexibility to choose between CFDs and FX options for your trading needs.

Step 2: Understanding Forex CFDs in Forex Trading

CFDs (Contracts for Difference) are derivative products that allow traders to speculate on price variations of underlying Forex assets without owning them directly. To delve deeper into CFDs, explore our informative resource on ‘What are CFDs?’

Step 3: Exploring FX Options

FX options are derivative contracts that grant you the right (but not the obligation) to buy or sell a Forex contract at a predetermined price on a specified date. Profits and losses from both CFDs and Options trades are influenced by trade position size and price movements between entry and exit points.### Step 3: Select a Broker

A broker grants access to the Forex market. It is crucial for every trader to carefully choose their broker as this partner will be essential to your trading journey.

Things to consider when picking a Forex broker:

- Regulation: The number of licenses and jurisdictions permitting the broker’s operations, the security of funds, transparent services, and other relevant criteria.

- Trading Platforms: The variety of trading platforms available, their reliability, range of tradable assets, automated strategies, cross-device functionality, user-friendliness, trading costs, and more.

- Trading Resources: Ensure the broker provides an Economic Calendar, educational materials, a demo account, trading calculators, risk control tools, and other resources.

- Payment Methods: Look for secure and convenient payment options, fast deposits, and especially hassle-free withdrawals.

- Customer Service: Expect professional, responsive service with exceptional support from your broker.

AvaTrade offers all these features and more. As a highly reputable brokerage firm, AvaTrade guarantees an outstanding trading experience.

Step 4: Establish a Trading Account in Forex Trading

Once you have chosen a broker, you should open a trading account to trade your preferred Forex assets. Explore the account options available and choose the one best suited to your requirements.

For all traders, especially beginners, starting with a demo account is advisable to practice trading without risking real money. When you are ready to trade for potential profits, transition to your real money trading account.### Step 5: Develop a Trading Plan

Crafting a trading plan involves creating a detailed roadmap outlining your trading approach. It aids in maintaining focus by adhering to well-defined objectives rather than engaging in impulsive trades. A comprehensive trading plan encompasses elements such as:

- Trading strategy

- Trading objectives and aspirations

- Risk management strategies

- Trading journal

- General trading guidelines

- Trading psychology considerations

A structured trading plan enhances decision-making efficiency and fosters the discipline necessary for achieving consistent success in the Forex market.

Step 6: Select a Forex Pair for Trading

Within the Forex market, there is a wide array of currency pairs classified into major, minor, and exotic categories. These pairs vary in terms of liquidity and volatility, which directly influences their spreads and overall risk exposure.

For newcomers, opting for a highly liquid pair with low spreads is recommended. Additionally, trading assets with extensive media coverage ensures access to abundant information for conducting thorough and insightful analyses. Some of the popular forex pairs available for trading with AvaTrade include EURUSD, GBPUSD, USDJPY, USDCHF, and more…

Step 7: Market Analysis in Forex Trading

In Forex trading, your success or failure hinges on your entry and exit points. Conducting a thorough analysis of your preferred assets is crucial for identifying prime market opportunities and determining optimal price levels to capitalize on these opportunities. Traders commonly use three types of analysis in the Forex market:

- Technical Analysis – involves analyzing price chart patterns, graphical elements, and mathematical functions to forecast future price movements.

- Fundamental Analysis – focuses on evaluating economic factors that influence an asset’s price to determine its fair market value.

- Sentiment Analysis – revolves around studying the prevailing market sentiment shown in open Buy/Sell positions and COT (Commitment of Traders) reports.

In the end, there isn’t a right or wrong strategy, nor is there a superior one. Traders should have a comprehensive understanding of all analysis types. Incorporating multiple analysis approaches can help identify new opportunities and uncover potential risks. Through experience, traders can develop a personalized strategy that fits their risk tolerance and trading style.

Step 8: Buy or Sell

Once you have completed analyzing the selected currency pair, you can decide whether to buy or sell.

In Forex trading, you go long (buy) when you anticipate the price of the underlying asset will increase. Conversely, you go short (sell) when you expect the price of the asset to decline.

For example, during analysis, if you spot a signal to buy the EURUSD pair when the price is dropping towards a support level, you might wait to buy at 1.1700 if the current price is 1.1750, speculating that the price won’t break below that support level.

Alternatively, if 1.1800 is seen as a significant resistance level, you could consider selling the EURUSD pair if it reaches that point.

Step 9: Risk Management

While the Forex market offers abundant opportunities, it also comes with risks. To enhance your chances of success in the long run, it’s crucial to have a robust risk management strategy in place.- Risks faced by traders in markets:

- Volatility risk

- Liquidity risk

- Leverage risk

- Market risk

Steps to Effectively Monitor Trade Positions:

- Stay updated on emerging news and events.

- Set up alerts to stay informed.

- Subscribe to trading signals for market insights.

- Follow top traders and influencers on social media.

- Utilize monitoring and reporting features provided by trading platforms and apps.

Closing Your Trade:

After opening and monitoring a position, the next crucial step is knowing when to close it. Closing a trade determines whether you make a profit or incur a loss. Having a sound exit strategy helps in managing risk exposure and maximizing profits.

You can consider closing your trade when:

- It reaches predefined stop loss or take profit levels.

- The trading session/week is ending with potential risks in the upcoming session/week.

- To prevent a margin call.

- Seize a new lucrative opportunity by freeing up capital.

- Changes in the market situation invalidate your initial analysis. One of the most crucial moments in Forex market history occurred on January 15th, 2015, when the Swiss National Bank (SNB) decided to ditch the Euro-peg on the Swiss franc.

Since September 2011, the SNB has maintained a floor price of 1.2000 on the EURCHF rate. This meant that the exchange rate could not drop below that level, allowing only upward movement.

On the day the SNB abandoned the peg, the EURCHF pair plummeted below parity (1.0000), causing the Swiss franc to surge over 30% in just one day. For comparison, the pair had traded within a narrow range of 1.2000 to 1.2360 throughout 2014. However, on January 15th alone, EURCHF plunged as low as 0.8050, marking a loss of approximately 4000 pips.

While most currency pairs typically see price changes of 100-200 pips during turbulent periods, the extreme fluctuations on that specific day highlight the significant risks and opportunities inherent in the Forex markets.

Similar to other markets, the prices of Forex assets are influenced by factors such as Central Bank Decisions and Interventions, Economic/Political News and Events, and Market Sentiment.

For more information on these and other factors impacting Forex markets, please refer to our What is Forex page.

Some Effective Forex Trading Strategies

There exist several trading strategies that traders can utilize to identify and capitalize on high-quality trading opportunities in the market. To achieve consistent trading success, traders must have adaptable strategies that enable them to maximize opportunities across various Forex market conditions.

Consider the following Top Strategies:

-

Price Action Trading

Price action stands out as the most straightforward form of technical analysis, involving the interpretation of market participants’ behavior through raw prices. Most price action strategies involve utilizing ‘naked’ charts and candlesticks.

The most common types of Forex charts used for price analysis:

-

Line Charts

Line charts are created solely using closing prices, thereby smoothing out price action and facilitating the clear identification of trends, major support, and resistance areas.

-

Bar and Candlestick Charts

Bar and candlestick charts offer more detailed price information over specific periods. In addition to closing prices, a single price bar or candlestick also displays open, high, and low prices achieved during each period.

Market price movements give rise to various types of candles and candlestick patterns. Reading these patterns can provide insights into emerging or dominant market sentiments.

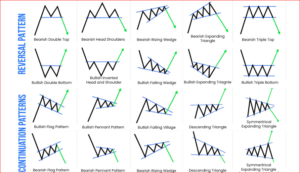

Popular candlestick formations like head and shoulders, double bottoms, and bullish/bearish engulfing patterns offer diverse price action signals, including trend continuity, trend reversal, and trend neutrality in the markets.

Trend-Following Strategies

An enduring wisdom in financial markets is the concept that ‘the trend is your friend.’ The principle emphasizes aligning with market movements rather than opposing them. Trends fall into three categories: Bullish (uptrend), Bearish (downtrend), and Neutral (sideways).

When engaging in directional trading within uptrends or downtrends, it is crucial to assess their momentum, velocity, and longevity. Sideways trends involve price fluctuations between support and resistance levels. Markets typically exhibit more ranging behavior than trending behavior. Consequently, it is essential to employ strategies that efficiently capitalize on opportunities within range-bound markets.

Breakout Trading

Markets are not perpetually stagnant. Over time, established support and resistance levels are breached, giving rise to new trends. Traders should remain vigilant for breakout chances to participate in emerging trends from their inception.

Forex Trading Tips- Utilize a demo trading account – It’s important to always utilize a demo account, regardless of your experience level. Using a demo account allows you to continually enhance your trading skills, test new strategies, adjust leverage levels, and explore new markets without any risk. Remember, practice makes perfect.

- Keep learning – The financial markets are constantly evolving. Stay committed to learning more about the markets to enhance your trading skills and knowledge.

- Always use stop losses – Due to the high risk involved in Forex trading, it’s crucial to always protect yourself by using stop losses.

- Control your emotions – Emotions can often cloud judgment in trading. Make sure to keep your emotions in check and stay objective throughout your trading activities.

- Keep a trading log – Maintain a detailed trading journal to track your activities. This will help you stay accountable and identify successful strategies as well as areas for improvement in your trading approach.