Cryptocurrency Trading; How To Start As A Beginner

Cryptocurrency Trading Essentials for Beginners: A Guide to Buying and Selling Digital Assets

Cryptocurrency trading involves speculating on cryptocurrency price movements through methods like CFD trading accounts or buying/selling coins on exchanges. CFD trading allows betting on Bitcoin price changes without owning the actual coins. You can go long (buy) if you predict a rise in value or short (sell) if you expect a decrease. These leveraged instruments require minimal deposits for exposure to the market, amplifying both gains and losses. Additionally, investors use cryptocurrency options to manage risk or increase market exposure by trading derivatives linked to underlying crypto asset prices.

Before diving into crypto trading, it’s crucial to grasp the assets and technologies involved, with Bitcoin being the foundation for many other cryptocurrencies. Similar to stock markets, cryptocurrency trading can be intricate, requiring knowledge of various components. Since its inception in 2009, Bitcoin remains the leading cryptocurrency in terms of market capitalization and adoption.

In recent years, an entire industry of alternative digital assets has emerged, offering tradable opportunities for profit. These assets, known as altcoins, encompass all cryptocurrencies apart from BTC, with Ether (ETH) being the most prominent among them. This guide serves as a primer on crypto trading strategies, covering trading platforms, trade components, trading styles, and the significance of technical and fundamental analyses in formulating a comprehensive trading approach.

Getting Started with Cryptocurrency Trading

There are various methodologies available for trading cryptocurrencies. To begin trading these digital assets, individuals must first acquire a thorough understanding of the subject matter, along with an awareness of associated risks and relevant laws based on their jurisdiction. Decisions regarding trading should be informed by this knowledge.

Creating an Account on a Cryptocurrency Trading Exchange

To engage in cryptocurrency trading, you will need to register an account with a cryptocurrency exchange unless you already possess digital assets. Leading crypto brokerage platforms such as Coinbase, eToro, and Gemini offer user-friendly interfaces and a diverse selection of altcoins.

When signing up with a cryptocurrency exchange, you will be required to provide personal identification details, similar to opening an account with a traditional stock brokerage. The registration process typically involves submitting your address, date of birth, Social Security number (for U.S. residents), and email address, adhering to the Know Your Customer (KYC) requirements. Deposit funds into your account

After signing up with a crypto brokerage, you will be required to link your bank account. Debit cards and wire transfers are commonly accepted for bank deposits by most cryptocurrency exchanges. Wire transfers, available on platforms like Coinbase and Gemini, are typically the most cost-efficient method to fund your account.

Select a Cryptocurrency Trading for Investment

Many crypto traders opt for Bitcoin and Ether, considering them as primary choices. However, trading based on technical indicators is feasible due to the more predictable nature of these cryptocurrencies compared to smaller altcoins. Some investors allocate a portion of their funds to altcoins, which, despite being riskier than larger digital assets, offer greater upside potential, especially with mid-market cap cryptos.

Commence Trading

For those interested in employing a crypto trading strategy, platforms like Coinrule offer automated crypto trading services. By utilizing crypto trading bots, you can align your trading activities with your investment goals to maximize returns. Automated trading not only enables swift profit generation but also allows diversification of your portfolio with various risk profiles, from conservative to aggressive approaches. Additionally, you may engage in active cryptocurrency trading on specific platforms while automating trading on others.

Secure your Cryptocurrency Trading

If actively trading Bitcoin (BTC), keeping your funds on the exchange is crucial for accessibility. For long-term holding of cryptocurrencies, consider acquiring a Bitcoin wallet. There are two main types of cryptocurrency wallets: software and hardware. While both ensure security, hardware wallets provide the highest level of protection by storing your digital assets on an offline physical device.Understanding the Fundamentals of Cryptocurrency Trading

The value of Bitcoin fluctuates constantly, being influenced by an always-active market. Operating as a self-governing digital asset whose value is dependent on an open market, Bitcoin introduces unique hurdles related to volatility that are not encountered by most traditional currencies.

Therefore, beginners must possess a basic understanding of how crypto-asset markets function to navigate the markets securely and make the most of their involvement in the cryptocurrency trading sphere. Bitcoin trading varies in scope and intricacy, encompassing simple transactions like converting to fiat currencies such as the U.S. dollar, as well as employing various trading pairs to profitably engage with market movements to enhance one’s investment portfolio. Importantly, as the size and complexity of a crypto trade increases, so does the trader’s exposure to risks.

To begin, let us explore some fundamental principles.

Essentials of a Cryptocurrency Trading

A cryptocurrency trade takes place between a buyer and a seller. Given that a trade involves two conflicting parties—a buyer and a seller—one party will inevitably benefit more than the other. Consequently, trading inherently operates as a zero-sum game, resulting in a winner and a loser. Acquiring a foundational comprehension of how cryptocurrency markets function can aid in minimizing potential losses and maximizing potential gains.

Upon agreement on a price between the buyer and the seller, the trade is executed (through an exchange), establishing the market valuation for the asset. Typically, buyers tend to place orders at prices lower than those of sellers, shaping the two opposing sides of an order book. When there are more buy orders than sell orders for a cryptocurrency, the price typically rises due to increased demand for the asset. Conversely, if more people are selling than buying, the price tends to fall. Many exchange platforms display buy and sell orders in distinct colors to provide traders with a quick snapshot of the current market conditions.

Buying and Selling in Cryptocurrency Trading

The concept of “Buy low, sell high” in trading highlights the fundamental principle of seeking to purchase assets at lower prices and sell them at higher prices. However, determining what constitutes “low” and “high” prices can be relative. This saying simplifies the basic motivations of buyers and sellers in a market setting.

Essentially, buyers aim to acquire assets at the lowest price possible, while sellers aim to maximize their profits. While this strategy is generally sound, there is an additional layer to consider when deciding to go long or short on an asset.

Going long on an asset involves purchasing it with the expectation of profiting from its upward price movement. Conversely, shorting an asset entails selling it to repurchase it at a lower price point to profit from a price decline. Shorting, however, is more intricate as it involves selling assets that are borrowed and must be repaid later.

To the average person, “the market” may appear as a complex system understood only by experts. In reality, it simply boils down to people engaging in buying and selling. Initially, navigating crypto trading may seem obscure. However, as you delve deeper into the concept, it becomes more straightforward.

The collective activity of buying and selling orders in a market represents a snapshot at a specific point in time. Analyzing the market involves a continual process of identifying patterns or trends over time, enabling traders to make informed decisions. Within the market, two predominant trends exist: bullish and bearish.

Bullish and Bearish Market in Cryptocurrency Trading

A “bullish” market, or bull market, is characterized by a consistent upward movement in prices, often referred to as “pumps” due to increased buying pressure. Conversely, a “bearish” market, or bear market, demonstrates a steady decline in price action, termed “dumps” because of widespread sell-offs leading to price decreases.

Bullish and bearish trends can coexist within larger opposing trends based on different timeframes. For instance, a short-term bearish trend may occur within a broader long-term bullish trend. Typically, an uptrend features price action marking higher highs and higher lows, whereas a downtrend involves lower highs and lower lows.

In the world of trading, “consolidation” represents a market state where prices move sideways or within a specific range. Typically, these consolidation phases are most easily identified on longer timeframes like daily or weekly charts. This state occurs when an asset is pausing after experiencing a sharp uptrend or downtrend. Consolidation can also signal an upcoming trend reversal or a period of low demand with decreased trading volumes. During consolidation, prices remain confined within a specific range. Hunting the Whale

Price Fluctuations in Cryptocurrency Trading

Price fluctuations in various markets are often influenced by high-net-worth individuals or groups known as “whales.” These whales, serving as “market makers,” strategically place bids and offers to enhance liquidity for an asset and generate profits. Whales play a significant role in multiple markets, including stocks, commodities, and cryptocurrencies.

To formulate a successful cryptocurrency trading approach, it is crucial to understand the trading tools favored by whales, such as their preferred technical analysis indicators. Essentially, whales possess expertise in their endeavors. By predicting the actions of whales, traders can align their strategies with these skilled operators to achieve profitable outcomes.

Emotional Market Cycles

Amidst a sea of metaphors, it is essential to remember that actual individuals—driven by emotions—affect market dynamics significantly. This human element in trading is illustrated in the well-known chart showcasing the “Psychology of a Market Cycle.”

While the bull versus bear market paradigm is valuable, the psychological cycle referenced above offers a more intricate view of market sentiment. Although traders are advised to trade devoid of emotions, the influence of mass psychology often dominates. The progression from hope to euphoria is fueled by “FOMO,” the fear of missing out, experienced by those who have yet to enter the market.

Navigating the spectrum between euphoria and complacency is key to timing an exit before bearish sentiment sets in and triggers panic selling. It is crucial to consider high-volume price movements, as they can indicate the overall market momentum. The strategy of “buying low” is evident, as the optimal time to accumulate assets in the market cycle is often during the downturn following a significant price decline. Remember, the higher the risk, the higher the potential reward.

Serious traders face the challenge of divorcing emotions from their trading decisions amidst the flood of opinions and analyses from the media, online forums, and self-proclaimed experts. These markets are vulnerable to manipulation by influential entities that sway market sentiments. Conduct thorough research and act decisively in your cryptocurrency trading endeavors.

Essential Tools in Cryptocurrency Trading

Identifying patterns and trends in the market is vital for gaining a comprehensive view of the landscape. Understanding your position relative to the broader market is crucial. Strive to be the seasoned surfer who recognizes the impending perfect wave rather than aimlessly floating in the hopes of a fortuitous event.

Moreover, paying attention to the micro perspective is essential for shaping your specific trading approach. While there exist numerous technical analysis indicators, we will focus on the fundamental ones.

Key Concepts: Support and Resistance

Two fundamental technical analysis concepts, “support” and “resistance,” pinpoint crucial price levels that often act as barriers, constraining price movements from straying too far in a particular direction. Support is the level at which a downward trend tends to halt due to increased demand, leading traders to buy at lower prices and form a support line. On the other hand, resistance is the level where an upward trend pauses due to selling pressure.

Many cryptocurrency traders utilize support and resistance levels to speculate on price movements, adjusting their strategies as prices breach upper or lower boundaries. Identifying these levels establishes a trading zone for entering or exiting positions, typically involving buying at support and selling at resistance.

Breaking through these levels offers insight into the market sentiment, with new support and resistance points emerging as trends evolve continuously. Endeavor. Moving into the future can trend higher and lower over time, causing support and resistance points to shift accordingly.

Traders often observe the sequence of support and resistance levels to discern broader trends, reflected in trendlines. In an uptrend, resistance levels develop as price growth slows and retreats to the trendline. Maintaining attention on the support levels of an upward trendline helps prevent significant price declines. Similarly, in a downtrend, traders monitor descending peaks to form a trendline that guides their decisions.

“The trend lines depicting upward and downward movements”

“The primary factor revolves around the historical data of the market. The resilience of support or resistance levels and their corresponding trend lines progressively strengthens with recurring occurrences over time. Consequently, traders document these barriers to shape their ongoing trading tactics.”

Round numbers in Cryptocurrency Trading

One aspect influencing the levels of support and resistance is the fixation on price levels that are round numbers by both inexperienced and institutional investors. When numerous trades are centered around a whole number as commonly observed with Bitcoin whenever its price nears a figure divisible by $10,000, for instance breaking past this threshold can pose a challenge, thus forming a resistance. This recurrent phenomenon underscores that human traders are susceptible to emotional influences and tend to opt for shortcuts. Particularly in the case of Bitcoin, reaching a specific price point often triggers an enthusiastic surge in market activity and anticipation.

Moving averages

Building upon the market’s historical support and resistance levels, and the resultant upward or downward trend lines, traders frequently aggregate this data to generate a consolidated visual representation known as the “moving average.”

The moving average adeptly tracks the lower support levels of an uptrend as well as the resistance peaks during a downtrend. When scrutinized in alignment with trading volume, the moving average serves as a valuable indicator of short-term momentum.

Chart Patterns to Consider in Cryptocurrency Trading

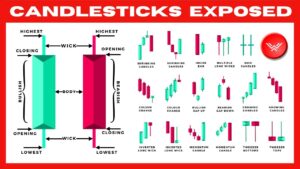

There exist various methodologies to map the market and identify inherent patterns. One of the most prevalent graphical depictions of market price movements is through the use of “candlestick” patterns. These candlestick configurations offer traders a visual language to anticipate potential trends.

Candlestick charts were developed in Japan during the 1700s to gauge how traders’ emotions impact price movements, going beyond basic supply and demand principles. This visual representation of the market is highly preferred by traders as it can convey more data compared to simpler line or bar charts. A candlestick chart typically includes four price points: opening, closing, highest, and lowest prices.

Candlesticks

In the context of cryptocurrency trading, candlesticks derive their name from their rectangular shape and the wicks that resemble candle flames. The wider part of the candle indicates the price at which it opened or closed, depending on its color. The wicks show the price range at which the asset was traded during a specific period represented by the candlestick. Candlestick charts can cover various timeframes, from minutes to days, and display different trends based on the chosen duration.- Developers

When considering an investment in a cryptocurrency asset, it is crucial to evaluate the competence and integrity of the individuals responsible for its development. What is their past performance? Which software projects have they successfully introduced to the market previously? How actively are they engaged in enhancing the underlying protocol of the token? Given that many projects are open-source, one can directly observe this engagement through collaborative code repository platforms such as GitHub.

-

Community

The community plays a vital role in cryptocurrency trading ventures. The fusion of users, token holders, and enthusiasts forms much of the momentum behind these assets and their foundational technologies. Ultimately, there is always a social aspect to any new technology. Nonetheless, due to the significant financial stakes involved coupled with the prevalent presence of amateur retail investors the industry often experiences toxicity and factions in conflict. Therefore, fostering a healthy, transparent dialogue within the community is encouraged.

-

Technical Specifications

Distinguishing itself from market technical analysis, the essential technical specifications for a crypto asset include the network’s algorithm selection (which dictates security, uptime, and consensus) and features related to issuance/emission, such as block times, maximum token supply, and distribution strategy. By meticulously examining the protocol stack of a cryptocurrency network and the monetary policy integral to the protocol, a trader can gauge whether these attributes support a prospective investment.

-

Innovation

While Bitcoin was initially conceived as electronic money upon its debut, developers and entrepreneurs have not only unearthed new utilities for the Bitcoin blockchain but have also devised entirely novel protocols to accommodate a broader array of applications. Liquidity and Influence of Major Investors

Ensuring ample liquidity is essential for a thriving market. It is important to identify respected exchanges that endorse a specific cryptocurrency. Determining available trading pairs and evaluating trading volumes are crucial steps. Moreover, analyzing the impact of significant market participants and their trading activities is imperative.

Establishing liquidity is a gradual process, particularly for a novel protocol that may not have immediate access to sufficient liquidity. Engaging in such investments carries inherent risks. When trading volumes are low and few trading pairs are accessible, it essentially becomes a bet on the project’s potential to attract a robust market over time.

Branding Strategies and Marketing

The majority of cryptocurrency networks lack a centralized authority to oversee branding and marketing efforts, resulting in a fragmented approach that lacks cohesion. However, over time, branding and marketing initiatives may gradually evolve within a protocol. Conducting a comparative assessment of the marketing endeavors undertaken by core developers, corporations, foundations, and community members offers valuable insights into how various entities communicate value propositions to the public.

Technical Infrastructure

The caliber of a cryptocurrency project can be gauged based on its technical framework. Beyond what is documented in whitepapers or presented at conferences, examining the tangible implementation of the protocol is crucial. Understanding the different stakeholders involved, including developers, block validators, merchants/companies, and users, is essential. Additionally, comprehending the network’s custodians, their role in network security (such as mining and validation), and how authority is distributed among stakeholders is key.

Blockchain Data Analysis

Given that all cryptocurrencies operate on blockchain technology, a new form of analysis known as on-chain analysis has emerged. This analytical approach relies on data derived directly from blockchains, providing valuable insights into cryptocurrency transactions and behaviors. When examining supply and demand trends, transaction frequency, transaction costs, and investors’ buying and selling behaviors of a cryptocurrency, analysts can draw detailed qualitative and quantitative insights into the robustness of the cryptocurrency’s blockchain network and its price dynamics across various markets.

On-chain data further offers a valuable understanding of investor sentiment as analysts can link macro and microeconomic events with immutable actions recorded on the blockchain.

Analysts actively seek out crypto trading signals, patterns, and irregularities in buying, selling, and holding activities about market upsurges, downturns, regulatory changes, and other network-centric occurrences. This analysis enables them to predict potential future price shifts and anticipate investor responses to forthcoming events such as network upgrades, coin supply reductions, and activities in traditional financial markets.

Cryptocurrency Trading vs. Stock Trading

Cryptocurrency and stocks represent distinct forms of investments. Despite both being liquid assets suited for speculative portfolios, their differences abound. These investment instruments should be managed in separate segments of a portfolio.

Stocks symbolize ownership shares in publicly traded companies. Each stock purchase equates to a proportionate ownership stake in the firm, relative to the total shares outstanding.

Investors can realize profits by trading stocks with other investors. The capital gains, derived from the variance between the buying and selling prices, constitute the return on investment. Additionally, the perks of stock ownership hinge entirely on the performance of the underlying company, which can be appreciated through dividend payments and shareholder voting rights.

A cryptocurrency is a type of digital asset that solely exists on the internet. It lacks a physical form and only manifests as entries in a digital ledger that monitors ownership. In contrast, the United States dollar has a physical aspect (such as paper currency) and a digital aspect (represented by bank account balances). Each unit of a cryptocurrency is known as a token, similar to how each unit of a stock is known as a share.

Trading in Cryptocurrencies involves risks

Engaging in trading necessitates effective risk management. It is crucial to determine the maximum acceptable loss for each crypto trade before entering it. This calculation may depend on various factors, such as the amount of trading capital available. For instance, an individual may choose to risk no more than 1% of their total trading capital on a single trade.

Trading itself is inherently risky. Predicting future market movements with absolute certainty is nearly impossible. It is essential to make informed decisions based on available information, personal judgment, and adequate education.

Furthermore, trading strategies can vary significantly among individuals based on their preferences, personalities, trading capital, risk tolerance, and other factors. Trading entails significant responsibility, and individuals considering trading must carefully assess their circumstances before deciding to participate.